Fintech: Client Onboarding Private Banking

Project: Customer onboarding for private banking and mortgage product selection was in 2017 an innovative process to digitize processes for private banks and finical institutions and speed up account creation. It provided a new use case of automation within the realm of fintech. Spanning a duration of five years, this endeavor helped to redefine how financial institutions approach the customer onboarding process.

Duration: September 2017 – September 2022

Cooperation: Offshore Development with Swiss Architects. Adam worked as a Software Architect Team member from Switzerland and Tam and Linh as Senior Software Developers in Vietnam. They have worked together on this project for 3 years. Linh stayed for a total of 5 years before joining Tam and Adam for the EdTech project.

We were part of dedicated teams commenced with an initial count of approximately 50 experts, which swelled to more than 120 engineers during the zenith of the project’s development phase. This collaborative effort was genuinely global in scope, encompassing 15 professionals from Switzerland. The Swiss contingent comprised technical visionaries, a Chief Technology Officer, up to 12 Product Owners, experts in product management, business analysts and seasoned developers. The remaining members of our team were situated in Vietnam, fostering a tightly-knit, intercontinental partnership. As part of this project we wholeheartedly embraced Agile methodologies, structuring our development teams into smaller, highly-efficient Scrum units, each comprising approximately eight members. This approach served as a catalyst for fostering collaboration and active involvement in pivotal team engagements, including Daily Stand-ups, Sprint Planning, Review, and Retrospective sessions.

User roles and perspectives

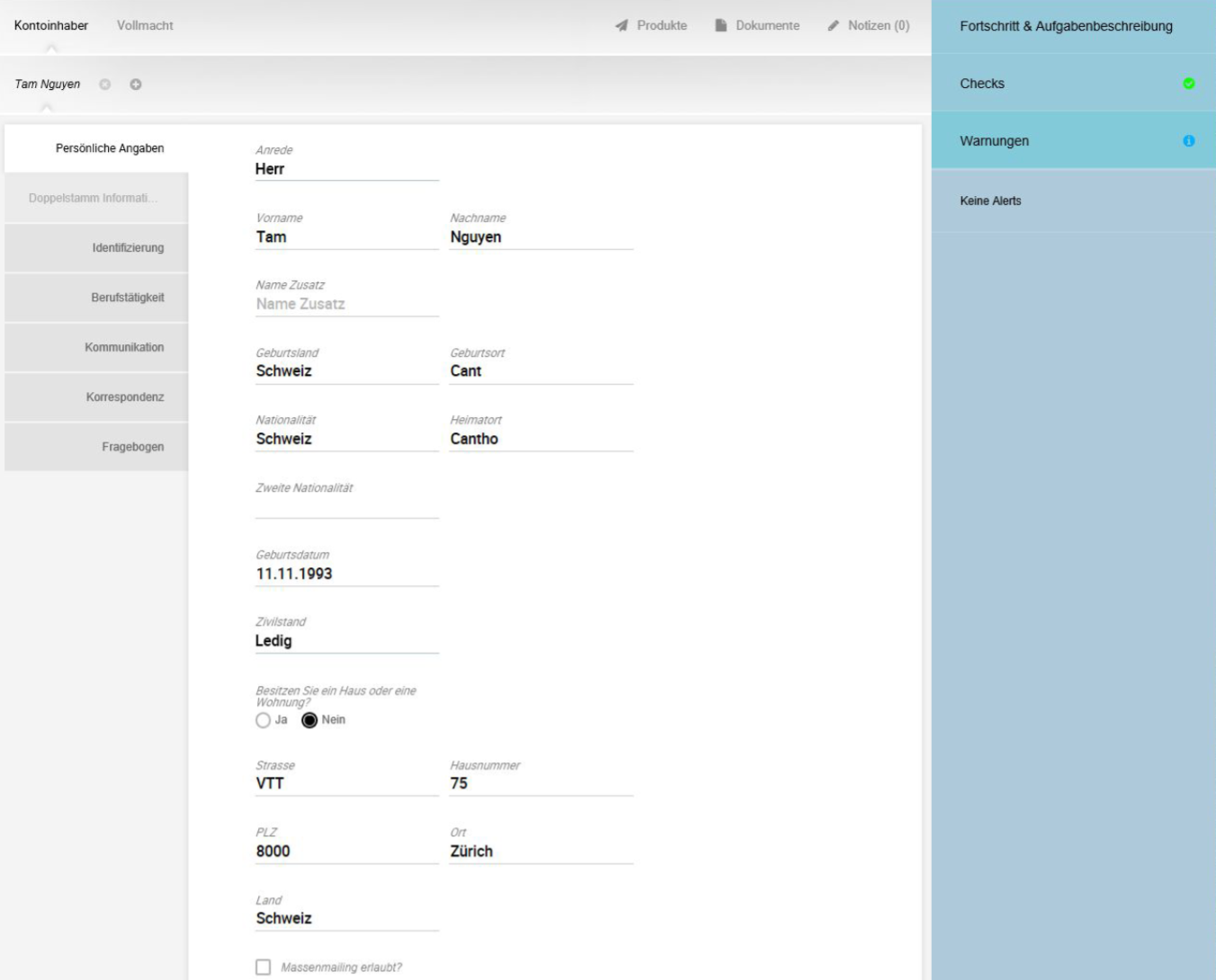

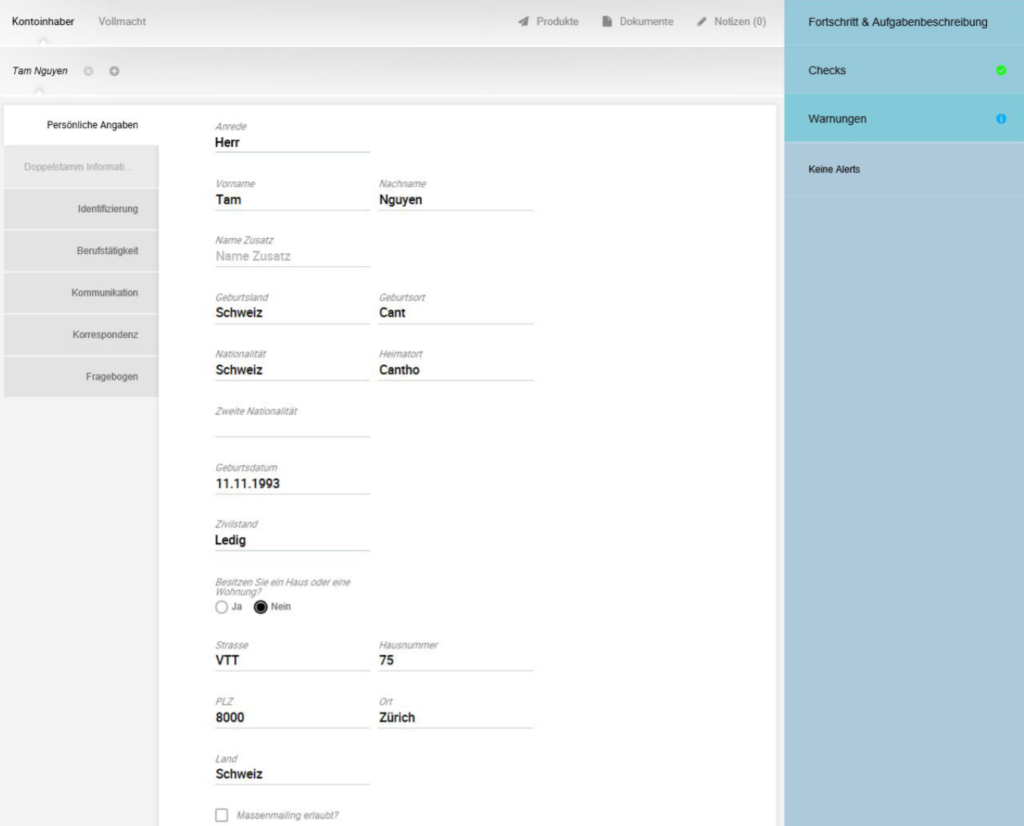

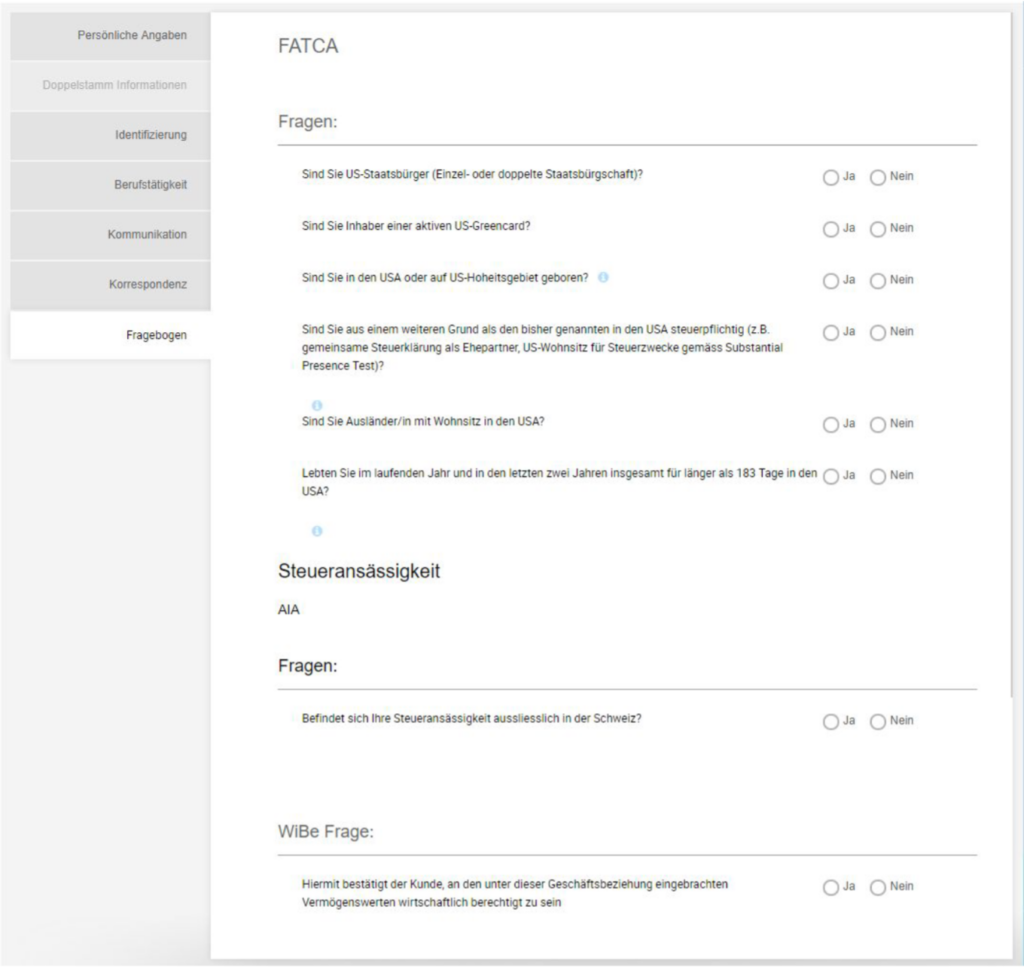

Bank Personnel Perspective: The bedrock of our solution, this comprehensive viewpoint was

meticulously crafted to empower banking professionals. It streamlines the gathering, administration, and validation of institutional business rules throughout the customer onboarding journey. Equipped with the capability to oversee user roles, access role-specific interfaces, and delegate responsibilities in accordance with assigned roles, this perspective also boasts a robust daily operational reporting system and potent risk assessment functionalities. Thus, it emerges as an indispensable component in risk identification and mitigation.

Compliance Officer Perspective: Tailored to meet the precise needs of compliance officers, this

perspective streamlines the process of clarifying and validating customer personal data. It seamlessly communicates outcomes to bank employees, ensuring the seamless progression of the onboarding process.

Technological Landscape

In this Fintech project we embraced JavaServer Faces (JSF) in a monolithic architecture, PostgreSQL, Axon.ivy Engine, PrimeFaces, Java, Hibernate, Elasticsearch, RESTful APIs, Jenkins. We introduced cutting-edge functionalities encompassing bank employee perspectives, user role administration, daily operational analytics, accountability tracking, and compliance officer insights.